hat are the consequences of economic inequality? Is it a problem to be studied

or is it an indicator of progress and freedom? A new paper [1] by three

psychologists inadvertently shows us how assuming the answer to this question can

be detrimental to science.

hat are the consequences of economic inequality? Is it a problem to be studied

or is it an indicator of progress and freedom? A new paper [1] by three

psychologists inadvertently shows us how assuming the answer to this question can

be detrimental to science.

Risk-sensitivity theory,[2] which comes from evolutionary biology, predicts that organisms will take greater risks when the variance in the payoff is higher (for example when they are near starvation), and become risk-averse when food and resource availability is high. That seems to describe modern Europe and North America rather well.

B. K. Payne et al.[1] hypothesized that people would take more risks when inequality rises. They define inequality to mean greater variance in income distribution. They asked their subjects to choose between two bets with equal average payoffs but different odds, or outcome variances. They found that people who were told that others were making more money, which the authors called high inequality, tended to take greater risks. It was not a big effect, but it was statistically significant. [3]

An individual experiencing an adverse outcome in an environment with inequality.

Participants were then given a choice to see the payoff of either the winners or losers before making their bet. Those who chose to see the upward comparison (the winners) made riskier bets in high-inequality case, when the potential payoff was higher. Those who chose to see the losers made riskier bets in the low-inequality case.

This doesn't mean much; since the participants voluntarily selected which case they looked at, the groups differed in their outlook before the experiment started. The results are consistent with loss aversion: if they knew they wouldn't lose much, or if they knew they could win more, they would make bigger bets. The results are explained by the fact that people overestimate low probabilities and underestimate high ones (this is called prospect theory, for which Daniel Kahneman got the Nobel Prize in Economics).[4]

Finally they counted Google Trends search terms like “pay day loans”, “invest”, and “no down payment” and status terms like “Ralph Lauren” and “well appointed house” (I am not making this up!) and tried to correlate it with inequality in different US states.

This one is really problematic, considering the different attitudes and ethnic composition in different states and the fact that Google searches are individualized, which means different individuals will get different results from the same search. This in turn means that Google statistics these days are of dubious value.

Is inequality good, bad, or neutral?

Despite this, the overall finding that economic inequality leads to greater risk taking could still be true. The Austrian economists Ludwig von Mises and Friedrich Hayek would certainly have agreed. The question is: is this good or bad?

The authors clearly think it is bad, claiming it's associated with violence, drug use, gambling, and shorter life expectancies:

Nations and states with higher levels of economic inequality tend to have higher rates of self-defeating decision making related to money, including crime (2), gambling (3), and greater consumer debt (4). Inequality is also associated with social and health problems, including higher rates of violence, drug use, and shorter life expectancies (5–7).

Given the historically high levels of income inequality in many countries, understanding the effects of inequality is a central concern across the social and medical sciences.

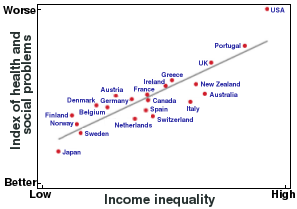

Refs. 5–7 are not, as you might think, Das Kapital and Piketty's book of a similar title, but sociology articles, one of which, from a paper by Pickett and Wilkinson [5], claims to have proven a causal link between income inequality and an index of “health and social problems” which is a weighted average of a grab bag of factors—some of which are merely subjective and others that are known to be endemic to multiethnic societies—including life expectancy, teenage births, imprisonment, obesity, homicides, and “distrust”.

Income inequality in different countries (redrawn from Pickett and Wilkinson [5]). The authors say the ‘index’ reflects life expectancy, mental illness, obesity, infant mortality, teenage births, homicides, imprisonment, educational attainment, distrust and social mobility, weighted in a specific way. Note: I have not yet been able to corroborate any of the data in this graph.

However, Wilkinson & Pickett's graph[5,6] of a ‘problems index’ vs. income inequality in different countries has some puzzling features. Only 21 of the 34 OECD countries are plotted, which raises the question of why they were selected and others omitted; alternative explanations seem have been overlooked, and the index looks to have been constructed to give the USA the highest score. The scientific basis for the index is questionable (how, for example, does income inequality produce obesity?). Having procured evidence to support their ideology, the authors pronounce income inequality “one of the most important problems of our time.”

I am still scouring bookstore remainder shelves to find the original data for that graph. Hopefully it will become clearer then. It seems to be one of those cases where each paper you read cites another earlier paper ad infinitum. I'll update this page when I find it.*

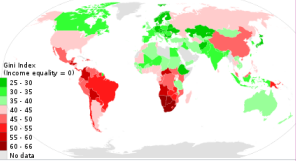

World Bank's Gini coefficient

One online encyclopedia published a map of countries with their Gini coefficient, which is a measure of income inequality where 0 = perfect income equality and 1 = perfect inequality. World Bank inequality figures are available for 157 countries. Amazingly, they're able to report Gini data from the “mid-2000s” and “Late 2000s”. I wish they'd post some stock prices from that era, though I guess they must mean the decade, not the century.

Income inequality (Gini Index map) from an online encyclopedia. This graph is based on World Bank 2014 data. Full size graph is at the source. http://wdi.worldbank.org/table/2.9

The World Bank data tell a completely different story from the 21 countries picked by Wilkinson & Pickett. From the Gini figures we learn that inequality in Denmark and Albania is about the same. Pakistan has the same amount as Germany. Afghanistan is about the same as Netherlands. Ukraine has the lowest and S. Africa and Comoros have the highest. If these numbers tell us anything at all, it is that low inequality does not equate to a successful, healthy and prosperous nation.

One thing they do tell us is that welfare states that tax the crap out of their citizens have, in general, lower after-tax inequality than those that don't. Germany goes from 0.504 (3rd highest among OECD nations, higher than the USA) to 0.295 (20th highest, much lower than the USA) after taxes.

Income diversity and the conservation of inequality

Anyway, call me unconvinced. If necessity is the mother of invention, doesn't that mean inequality is the engine of technological progress? In the extreme case, where people are prevented from gaining wealth and status, why would anyone still invent things? The other extreme, where one guy owns everything, would suck just as much (though one could argue that this too is a form of equality, since everybody is equal except for that one person).

If both extremes are undesirable, it follows that there must be some optimum level of inequality. Basic psychology tells us that motivated behavior always follows a downhill path: if the perceived benefits outweigh the costs (including the cost of evaluating it and the cost of getting off one's butt), the behavior will occur. Remove the possibility of economic benefit, and the economy will grind to a halt, like a Carnot engine without an inequality in temperature.

Without economic inequality, some other kind of inequality, such as inequality of power, must take its place to avoid stagnation. For a given amount of economic output the total amount of inequality always remains constant; only its form changes. (I call this the principle of conservation of inequality.)

Risk-taking, too, is a desirable thing: it gave us the US Constitution, the Hoover Dam, electricity, the Moon landing, the discovery of the New World, AT&T and Comcast. Okay, maybe a couple of bloopers there, but still mostly good things.

Maybe a society functions best when nobody has the same level of income as anyone else: if you maximize income diversity, you'd also maximize economic mobility, since every transaction would result in an increase or decrease in status, and risk-taking would be encouraged.

Is the goal of psychology to understand behavior? Or is it to provide justification for one's pre-existing political beliefs? These metapsychological questions need to be re-examined if psychology is to be regarded as a branch of science instead of mere politics.

After reading this paper, I wonder whether it might not be too late.

*Update (May 21, 2017): I finally found a copy of their book. It has exactly the same graph. I will dissect their argument here.

1. Payne KB, Brown-Iannuzzi JL, Hannay JW (2017). Economic inequality increases risk taking. Proc Natl Acad Sci U S A 114(18), 4643–4648. Link

2. Kacelnik A, Bateson M. (1997). Risk-sensitivity: crossroads for theories of decision-making. Trends Cogn Sci. 1(8), 304–309.

3. The high inequality group took 15% more risk (probability of losing = 0.51±0.24 vs 0.44±0.24 (mean±SD, total N=221, p=0.028). The correlation was also low but statistically significant, r=0.19, p=0.004.

4. Kahneman D, Tversky A. (1979). Prospect theory: an analysis of decision under risk. Econometrica 47, 263–291.

5. Pickett KE, Wilkinson RG. (2015). Income inequality and health: A causal review. Soc. Sci. Med 128, 316–326.

6. Wilkinson RG, Pickett KE (2009). The Spirit Level: Why More Equal Societies Almost Always Do Better. London: Penguin.

Created may 07, 2017; last updated may 21, 2017, 9:44 am