|

Deflation books

|

|

Deflation books

|

If you like a big sale, you're going to love 2014 and 2015. So says Harry S. Dent, Jr., investment consultant. Stocks will have a big 70% Off sale with the Dow crashing in early 2015, falling to 5,800 by mid-year and 3,300 by 2020, creating a wonderful investment opportunity for everybody. Home prices will crash, and oil will drop to $20 by 2015.* Everything must go!

Well, that hasn't happened to Dent's book yet: it's still full price. Meanwhile the Dow is pushing 18,000, thanks to QE and the zero interest rate policy. I suspect Dent is probably starting to sweat a little.

His predictions are based on demographic changes, or more precisely actuarial changes. Young people cause inflation, because they consume a lot and produce nothing, and old people cause deflation, because they get smaller. People do predictable things as they age. Consumer spending, for example, peaks at age 46. Ocean cruises peak at age 70, hospital bills at 58-60, cars at 53, and starter homes at 31. So Dent pores over the demographic charts, looking for trends.

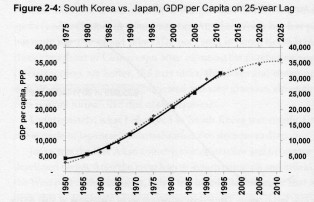

This book has lots of graphs to back up his ideas, but some of them look a bit strange. In one graph labor force growth tracks CPI, for instance, almost perfectly. Many of his graphs, like the one shown below, use time lags to make the curves line up. He explains why, but he's amazingly careless. On page 184 he says copper reached $450 per pound in 2011. Its actual price was $4.50. On the graph below, you have to look closely to see that he not only shifted the X axis, he also shrunk it for one curve to make the slopes the same. On page 116, his graph says Social Security where he means Medicare. On other graphs, he shifts a birth data curve (1900–2010) to the right by 47 years (to 1947–2060) and labels it “spending wave.” Yes, it's a projection, but why not just use real data? He is assuming his own conclusion here.

Are his predictions reasonable? Despite the number games, they might be if all other things remained equal. But family size has been shrinking and the job market turned to shit in 2008 and stayed there due to government intervention. People are being forced to move more often than ever. They don't stay in his categories like they used to.

Previously he predicted Japan's economy would start turning up by 2003, immigration would drop sharply after 2008, and the Dow would reach 40,000 by 2007.

Okay, so nobody's perfect. Still, unlike some economists in famous newspapers whose names we shall not mention, Dent recognizes that printing money will not help Japan and will only make things worse for us. His cycles don't account for geopolitical events like the war in Iraq or other pesky unknown unknowns, but they seem plausible. Even so, they can't account for the massive distortions in the market caused by government. Predicting the economy is a lot like predicting the climate. The theory makes sense intuitively, and it might even be sound, but it still could be 100% wrong. As with the climatologists, the trick is to make sure you get paid before the prediction is set to come true.

So don't pay too much attention to the dates of his predictions or his hokey graphs, but read this book for lots of interesting ideas on how demographic changes might influence long-term economic trends. Just keep two phrases in mind: “ceteris non paribus” and “the more government does, the worse things get.”

* Update, Dec 21 2015: Oil just crashed to $36.13 per barrel. Maybe this guy was on to something.

dec 21, 2014

Is deflation really more dangerous than inflation? Economists believe that wage rigidity means inflation should be 3% higher, so employers can reduce wages without workers complaining. Another pernicious myth, left over from Keynes, is that consumers withhold purchases during times of deflation and splurge in times of inflation, triggering a "deflationary spiral." Banks would supposedly stop making loans because asset prices in stocks and real estate decline. Wealth would disappear.

But is any of this really true, or is just more Keynesian statist nonsense? If the money supply tracked GDP precisely, making the assumption (not necessarily valid) that GDP is reported accurately, then inflation optimally should equal real growth. This allows people to make the longest term financial decisions.

If wealth can disappear because money stops moving around, can we say it was real to start with? Much of our fear of deflation is purely psychological.

The idea is that asset prices will decline, wiping out bank collateral. Bank assets are also tied to the stock market. So banks, it is said, go out of business. This is based on the highly stale assumption that wage rigidity is anything more than a psychological barrier.

Virtually every thing any economist says is likely to be wrong. But it doesn't matter. The average person needs to know what economists are thinking. Their theories affect the markets and have to be taken into account when planning. We have to know how this stuff so we know what to do in the unlikely event that we ever get any money.

jan 03, 2015