|

commentary

Keynesianism dying, has dandruffIf Keynesian economics worked, it would be a perpetual motion machine. Too bad it doesn't |

|

commentary

Keynesianism dying, has dandruffIf Keynesian economics worked, it would be a perpetual motion machine. Too bad it doesn't |

|

by T Nelson |

veryone has their own idea of which book is most responsible for the world's

current woes. If you're a conservative, it might be Das Kapital, Mein

Kampf, The Authoritarian Personality, Alinsky's Rules For Radicals,

or maybe The Kinsey Reports. If you're a liberal, it might be The Holy

Bible or anything by Ann Coulter or Glenn Beck.

veryone has their own idea of which book is most responsible for the world's

current woes. If you're a conservative, it might be Das Kapital, Mein

Kampf, The Authoritarian Personality, Alinsky's Rules For Radicals,

or maybe The Kinsey Reports. If you're a liberal, it might be The Holy

Bible or anything by Ann Coulter or Glenn Beck.

If we're talking about the worst books of all time, a few of us would add literary masterpieces like Estonian Sock Patterns All Around the World, or How To Avoid Huge Ships, or anything with the word “grey” in the title. But one could reasonably argue that the book that has done the most harm to the modern world is John Maynard Keynes's 1936 masterpiece The General Theory of Employment, Interest, and Money. The theory in this book is one of those huge ships that no one alive today is able to avoid, in much the same way that schools of fish deep in the ocean back in 1912 were unable to avoid that huge, unsinkable ship charging full steam at them from above.

The General Theory is the book that modern-day economists have taken as the blueprint for big government, out of control inflation, and welfare up the wazoo. It's been so popular that it's safe to say that our wazoos are no longer safe here in the Republic of Keyneslandia.

Just as Christianity attracts those who are inclined to believe in traditional values, and Austrian economics attracts those who value liberty, Keynesianism attracts advocates of big government. So big government is what we got. But if we've learned anything in the past 13 years, it is that government is not, and cannot be, the solution to our problems. Government is the opposite of freedom, and people are finally starting to realize that as we get more of one, we have less of the other. Any economic model that predicts that the economy will do what the model says is fatally flawed.

Thanks to John Maynard Keynes's theory, our government thinks that appropriating our money and throwing it away, for instance by digging holes in the ground and covering them up, is good for the economy. Forget the long-term consequences, say our economists; as Keynes famously said, in the long run we are all dead. Economists even today give Keynes credit for having made one prediction that, so far, has turned out to be accurate. Indeed, as Keynes himself predicted, he is now dead, and we are the ones who have to deal with those long-term consequences.

But if Keynes were alive today, he'd turn over in his grave (as the old joke goes). It is a little-known fact that Keynes gave us repeated warnings not to follow his theory, because he knew if it were followed it would lead to disaster.It is indisputable that government spending can improve the economy if it makes things easier for people to carry out business—for instance, infrastructure projects like the Internet or the American interstate highway system. But Keynes went much farther than this. He proposed what we now call the fiscal multiplier effect.

This is not related to the fractional reserve monetary multiplier, which is where banks loan out ten times as much money as they actually have, on the assumption that nobody ever really counts that stuff. The fractional reserve system works so well that the airlines now use it in booking passenger seats. The Keynesian multiplier is caused by spending, especially government spending, and it is often used as a justification for big government programs. But is it an economic phenomenon, a psychological one, or an illusion?

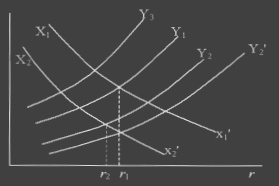

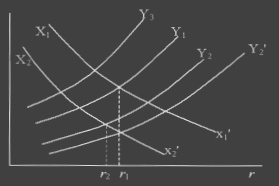

Keynes thought all government spending would stimulate demand, which would increase production. By his “multiplier effect,” for every dollar that the government pumps into the economy, overall wealth increases by more than one dollar. Suppose I borrowed or acquired a dollar from you by some nefarious means (such as by taxing you), and then gave it back to you. Obviously, there could not be a multiplier effect in this case. If government pours the money it stole from you back into your hands, the money is just going around in circles. The easiest way to get a multiplier is by printing up new dollars. When we do this, it's called counterfeiting, which is a form of stealing. When the government does it, it causes inflation, which is basically also a form of stealing, but on a larger scale and a little sneakier. So no matter how you achieve it, a multiplier effect is, clearly, a bad thing.

A multiplier effect also does not occur if people just exchange the money for some product. If it did, it would be the economic equivalent of a perpetual motion machine. The government could give out one dollar, wait for everybody to buy something until the multiplier takes effect, then take the dollar back, and repeat the cycle indefinitely, thereby creating an infinite amount of money. (Many other people have also called this a perpetual motion machine—proof that I am right!)

Keynes, of course, went much farther, saying that even money the government steals from our bank accounts (as they'll have to do eventually, if the deficit gets much bigger) stimulates the economy, because in the bank it's just sitting around, of no use to anybody (except the person who owns it, but he or she is not important.)

But in reality, spending by itself is still just money going around in circles. For there to be a multiplier, labor has to occur. For example, if A finds a ten-dollar bill lying around (say in C's back pocket), and hires B to do ten dollars worth of work, B now has ten dollars that he wouldn't have had otherwise, and A's company can now make more of a profit because of the improvements made by B. The multiplier effect does not come from the money itself, but from the labor that is done for it. It assumes that people would be sitting around doing nothing without the infusion of money, and that when they get the money from the government they suddenly start doing work.

Unfortunately, A's company now will produce more pollution and is required to install expensive pollution controls. Its taxes also rise, causing it to lay off workers and eventually move its production to China. In China it hires more workers, so its electricity usage is greater, so it produces global warming, which causes the planet to incinerate, killing everybody. So you can see once again that the multiplier effect is a very, very bad thing.

Because the multiplier effect is so bad, the government tries to avoid it all costs by paying people not to work. This is what we call “welfare.”

But Keynes's ideas are not something we should take lightly. Washington, D.C. is surrounded by rings of high-tech businesses that have grown wealthy on government contracts. Our defense industry is highly innovative, and today we have missiles that can fly halfway across the world at the push of a button, smash through your bathroom window and blow you to bits. Clearly a nice thing to have.

This is all thanks to big government, and it lends credence to enthusiastic supporters of Big Spending who consider even a hint of austerity to be the end of the world as we know it. And so, an almost continuous crisis state has to be engineered to justify it and keep the gravy train moving. The speed at which the gravy train moves is called the “velocity” of the money.

The biggest governmental stimulus, of course, is global war, which many claimed pulled the world out of the Great Depression. Now, not many people would suggest that a few dozen strategically placed H-bombs would be just the thing to bring our economy back to life. Keynes himself tried to blame the idea of war as a stimulus on the “classical” economists. But the idea that war contributes to “creative destruction” is one of the great myths of our time, and no one can deny that it is implied by his theory.

In order to use this principle of creative destruction, we have two political parties. The job of one party is to start wars, thereby destroying businesses in other countries, and building up our economy. The job of the other party is to make sure we lose the wars, thereby building up the businesses of our enemies and destroying our own so the next cycle can begin. This is called the business cycle.

But Keynes himself repeatedly warned that there were dangers. He warned, for example, that keeping interest rates low, as his theory recommends, would be catastrophic in times when there is an unfavorable trade balance (which is to say, always, these days). He proposed that 50% of any “stimulus” should come by reducing taxes, because this would keep government the same size, which suggests that, on some subconscious level, he must have thought that was a good thing.

Keynes also said it was not appropriate to pump money into the system except during a recession. His biographer Skidelsky quoted him as saying that such a policy would be a transition to socialism. In 1940 he advised the British to borrow money from taxpayers, with interest, instead of taxing them or burning up the currency with inflation. He even advised FDR that national purchasing power should be increased from governmental expenditure financed by loans and not by taxing present incomes.

These are policies that free-market libertarian economists would consider to be, well, maybe not necessarily good, but at least a step in the right direction. Of course, Keynes was famous for changing his mind, so no one knows for sure whether he really meant these things, or whether he changed his mind afterward, or whether he was just saying it to see if FDR was really as incompetent about economics as everybody thought. But FDR just nodded gravely and thanked Keynes for his advice.

Keynes believed he was saving capitalism and preventing the West from falling into the trap of totalitarian corporatism and socialism. But in the hands of his followers, his theories are leading us closer to the collectivism from which our ancestors fought and died to protect us. As Hayek warned us, even if we might have good intentions, treating economic problems by increasing the power of the central government is like playing with fire, and pushes us inexorably toward socialism. Of course, to modern Keynesianistas like Paul Krugman, this is considered the theory's main advantage.

We have also run up against an ironclad law: the longer the spigot has been turned on, the harder it is to turn off. People become dependent on continued government funding and base their business decisions on it. It also brings us to the golden rule of economics:

People always adapt to any economic policy in such a way as to cancel its intended effects.

In other words: any economic model that predicts that the economy will do what the model says is fatally flawed. For example, the more that Keynesian policies are followed, the more free market forces will be inadvertently stimulated. One corollary of this rule is this: the more emphatically someone in government tells you something will never happen, the more certain you can be that they have already done it.

As our economy becomes more dependent on financial manipulations that are both complex and unstable, there's an increasing tendency to rely on government's strong hand to control it. But it's considered impolite to say it this way: the government has one hand firmly on the economy and the other hand firmly in our pockets.